Last week the Feds met and decided to raise the federal funds rate a quarter percentage point from 1.75% to 2%. It also indicated it planned to raise this rate twice more this year. To finance geeks like me my response was, “It’s about time!” However, to the average Main Street resident the response was, “Huh?”

So, let’s first start by explaining what this even means. There is a committee within the Federal Reserve called the Federal Open Market Committee that meets eight times per year to set the fed (short for federal) funds rate. They also do a few other things to influence the supply of money in the economy like “open market operations” but that is beyond the scope of this article (shout out to my Macro Economics professor at University of Michigan!).

Anyway…this federal funds rate is the rate at which banks lend to other banks on an overnight basis. If the rate goes higher it makes it more expensive for Bank A to lend to Bank B so they will lend less; if the rate goes lower it makes it cheaper for Bank A to lend to Bank B so they will lend more.

After the recession started in 2007 there was a need to spruce up the economy and get banks lending again, so the Feds went into a barrage of rate cuts to spur or encourage lending. They actually did 10 rate cuts in a row to an all-time record low of .25% on December 17, 2008…they didn’t raise rates for seven years until December 2015, when they felt the economy stable enough to sustain a rate hike.

So what does this mean for you? The rate hike by itself isn’t significant, but what’s more significant to investors is the overall trend. Just like the price of a stock on a particular day doesn’t mean as much as the direction the stock is going (up or down), the fed funds rate should be viewed in the same way.

All analyst estimates say that we entering into a rising rate market where the feds should hike rates another two times this year. Therefore, here are a few ways you can benefit from a rising interest rate economy:

- Increased Lending – Banks were scared to lend after the financial crisis of 2007. Getting a loan to buy a home with the less a than perfect credit score seemed almost impossible. A rate hike gives a greater incentive to loan out reserves at higher interest rates. Increased lending could give a boost to housing markets, small businesses desiring capital and the economy as a whole.

- A Stronger Dollar – An interest rate hike, with more expected in the near future, causes the U.S. dollar to get more support. A stronger dollar means more purchasing power compared to other currencies. It’s not guaranteed, but if you planned on traveling to Europe you might be more pleased with what you can buy…bring me an Italian man purse that looks like LeBron’s!

- Higher Returns – I remember I used to help people shop between the various places to house your emergency fund…ahh…the good ole days of shopping for the best rate! Well, that could be coming back! This is also good news for seniors using CDs and savings accounts as savings vehicles…every little bit counts. (Side note…it will cost that senior more to take out a home equity line of credit on that home so if you are a senior, are already tight on cash and own your own home, down sizing could be an option.)

- Housing Market Improvements – As the Fed raises rates, mortgage yield increases will likely follow. I know of a few individuals who are happy they were able to refinance and lock in a lower rate before the hikes began. I know you might feel like jumping into this market now before rates get higher making the cost of the your loan higher, but NEVER let market conditions supersede your personal readiness to buy a home. I would love for you to be a homeowner, but not at the risk of messing up your credit because you bought and weren’t ready to deal with the burden.

- A Truer Trade – Okay, below is a picture of the Dow Jones Industrial Average for the past 10 years. In this you can see the dates of December 2008 when the Feds hit it’s record low rate of .25%. Many credit the Obama stimulus package as the reason we saw the turn around. I do give that a little credit; however, I give much larger credit to Ben Bernanke (the Fed Chairman in 2008) for keeping rates low, keeping reserve requirements favorable for banks and purchasing large amounts of government securities to inject unprecedented amounts of capital into the economy. Without that, I doubt we would have seen such a strong market appreciation. Consequently, we will have to get back to some good old fundamental research when investing in stocks….this is a good thing!

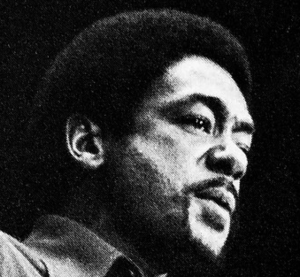

Ryan Mack is the President of Optimum Capital Management, LLC and the Director of Financial Education for Mobility Capital Finance. Mobility Capital Finance (“MoCaFi”) is a company on a mission to provide underserved Americans access to healthier financial products. Our strategy takes advantage of several important macro-trends including 1) most people have a smartphone 2) more and more financial transactions are being done on mobile devices which means that you, the banking consumer, can now complete banking transactions on your mobile device 3) bank branches are closing at record rates, especially in undeserved neighborhoods and soon you may not have the convenience of going to a nearby neighborhood bank 4) MoCaFi’s responsible and secure use of data and analytics allows us to offer you personalized financial products (i.e. a pre-paid debit card that allows you to increase your credit score by paying your rent). MoCaFi can change the trajectory of families’ lives.

Visit our web page to see how we can help you. (www.mocafi.com)

Originally posted 2018-06-19 08:26:20.